The Ultimate Guide To Top 30 Forex Brokers

The Ultimate Guide To Top 30 Forex Brokers

Blog Article

Indicators on Top 30 Forex Brokers You Should Know

Table of ContentsThe Top 30 Forex Brokers StatementsThe Of Top 30 Forex BrokersTop 30 Forex Brokers Can Be Fun For EveryoneThe Best Strategy To Use For Top 30 Forex BrokersTop 30 Forex Brokers for DummiesTop 30 Forex Brokers - An OverviewHow Top 30 Forex Brokers can Save You Time, Stress, and Money.The Only Guide for Top 30 Forex Brokers

Like various other instances in which they are made use of, bar charts supply more cost details than line charts. Each bar chart represents one day of trading and contains the opening price, greatest rate, most affordable rate, and closing price (OHLC) for a profession. A dashboard on the left represents the day's opening cost, and a similar one on the right represents the closing rate.Bar charts for money trading assistance traders identify whether it is a customer's or vendor's market. Japanese rice investors first used candle holder charts in the 18th century. They are visually a lot more attractive and less complicated to review than the chart kinds described above. The upper section of a candle is used for the opening cost and highest possible cost factor of a currency, while the lower section suggests the closing cost and least expensive cost factor.

What Does Top 30 Forex Brokers Mean?

The formations and forms in candle holder charts are used to recognize market instructions and activity. A few of the much more typical developments for candlestick charts are hanging guy - https://allmyfaves.com/top30forexbs?tab=Top%2030%20Forex%20Brokers and shooting star. Pros Largest in regards to daily trading quantity worldwide Traded 24-hour a day, five and a fifty percent days a week Starting resources can rapidly increase Generally complies with the same policies as regular trading More decentralized than typical stock or bond markets Cheats Utilize can make foreign exchange professions really volatile Utilize in the array of 50:1 prevails Calls for an understanding of financial fundamentals and indicators Less policy than other markets No revenue generating instruments Forex markets are the biggest in regards to everyday trading quantity around the world and consequently use the most liquidity.

Financial institutions, brokers, and dealers in the forex markets permit a high quantity of take advantage of, meaning traders can control large positions with reasonably little cash. Take advantage of in the series of 50:1 prevails in foreign exchange, though even higher amounts of utilize are offered from specific brokers. Utilize has to be made use of carefully since numerous unskilled traders have suffered significant losses utilizing even more utilize than was necessary or sensible.

Top 30 Forex Brokers for Dummies

A currency trader needs to have a big-picture understanding of the economic climates of the numerous nations and their interconnectedness to grasp the principles that drive money worths. The decentralized nature of forex markets implies it is much less regulated than various other financial markets. The level and nature of policy in forex markets depend upon the trading jurisdiction.

The volatility of a specific currency is a feature of numerous factors, such as the politics and business economics of its country. Occasions like financial instability in the type of a settlement default or discrepancy in trading connections with an additional money can result in substantial volatility.

The Ultimate Guide To Top 30 Forex Brokers

Currencies with high liquidity have a ready market and show smooth and predictable price activity in response to exterior events. The United state buck is the most traded money in the world.

Top 30 Forex Brokers for Beginners

In today's information superhighway the Foreign exchange market is no much longer exclusively for the institutional investor. The last 10 years have actually seen a boost in non-institutional traders accessing the Forex market and the benefits it supplies.

Fascination About Top 30 Forex Brokers

Fx trading (foreign exchange trading) is a worldwide market for dealing money. At $6. 6 trillion, it is 25 times bigger than all the world's stock exchange. Foreign exchange trading dictates the exchange prices for all flexible-rate currencies. As a result, rates transform constantly for the currencies that Americans are most likely to utilize.

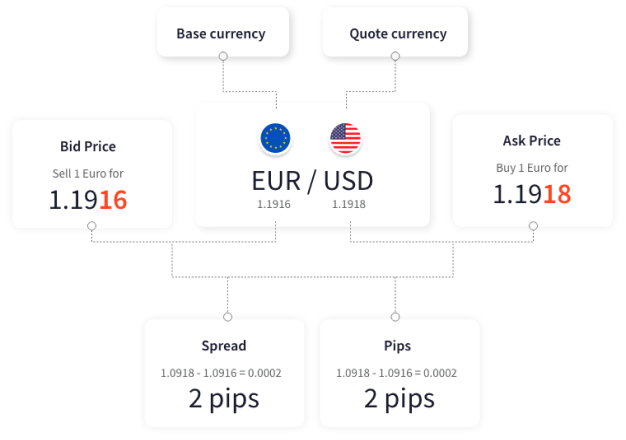

When you market your currency, you get the payment in a various money. Every traveler who has obtained foreign money has actually done forex trading. The investor buys a specific money at the buy cost from the market manufacturer and sells a various currency at the selling rate.

This is the deal cost to the trader, which in turn is the profit gained by the market maker. You paid this spread without realizing it when you traded your dollars for foreign currency. You would discover it if you made the deal, canceled your journey, and after that tried to trade the money back to dollars right away.

Top 30 Forex Brokers Fundamentals Explained

You do this when you think the money's value will certainly drop in the future. Services short a money to protect themselves from threat. Yet shorting is extremely risky. If the money climbs in get redirected here worth, you have to buy it from the dealer at that price. It has the same advantages and disadvantages as short-selling stocks.

Report this page